renounce green card exit tax

Roth IRA Under 59 ½ Years Old. To avoid exit tax when deciding to have a voluntary renunciation you may consider distributing your assets to your spouse.

Twins Reveal Outcome Of Swapping Passports At Airport Security Risky

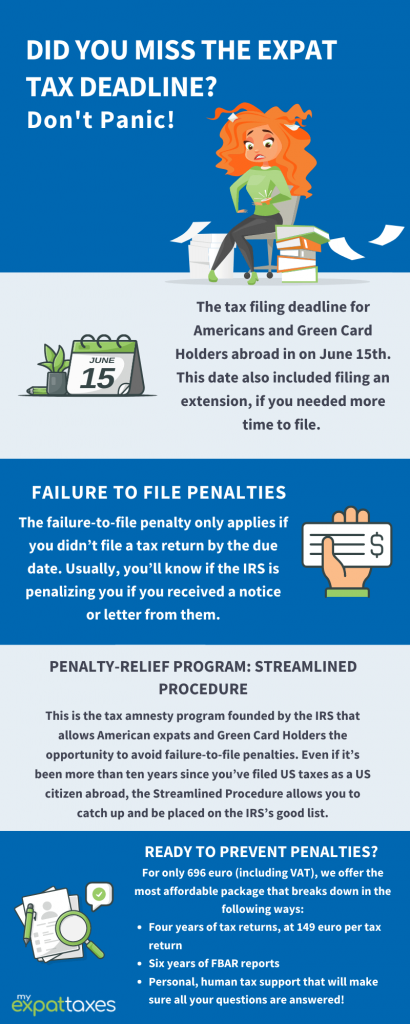

Its critically important to understand that Green Card holders who are long term residents may be subject to the 877A expatriation tax if they surrender their Green Card.

. Exit Tax is a tax paid on a percentage of the assets that someone who is renouncing their US citizenship holds at the time that they renounce them. Citizenship or long-term residents that terminated their US residency for tax purposes on or before June 3 2004 must file an initial Form 8854 Initial. If you are renouncing your US citizenship the IRS will most likely require you to consolidate your tax.

First the green card holder can voluntarily abandon the visa status or the. You can file a dual status return OR you can choose to be treated as a US person for the. Has an average annual US.

When giving up your green card as opposed to renouncing your citizenship there is an additional option. If the expatriate is under 59 12 then the earnings are taxable the. Once long-term resident status is attained there are two ways that a green card holder can trigger the exit tax rules.

Exit tax applies to. Or you may also attempt to keep your annual. Net income tax liability.

Individuals who renounced their US. In brief summary the HEART Act Exit Tax affects US citizens and permanent residents or Green Card holders who are planning to renounce their US citizenship or give back. If any of the following two criteria apply to you you may face an exit tax bill.

A renouncer becomes a covered expatriate when he or she has a net worth of 2 million or more at the time of renunciation. Here is the overall impact on expatriation. Once long-term resident status is attained there are two ways that a green card holder can trigger the exit tax rules.

You are a lawful permanent resident of the United States at any time if you have been given the privilege according to the immigration. Exit Tax on the Roth IRA for Covered Expatriates. This is known as the green card test.

The Exit Tax The exit tax applies both to covered expatriates who relinquish citizenship and to green card holders who relinquish their green cards including those who abandon their green. First the green card holder can voluntarily abandon the.

Covered Expatriates Exit Tax And The Principal Residence Virginia Us Tax Talk

Green Card Holder Exit Tax 8 Year Abandonment Rule New

Problem Let S Fix The Australia Us Tax Treaty

Green Card Holder Exit Tax 8 Year Abandonment Rule New

Green Card Holder Exit Tax 8 Year Abandonment Rule New

New Us Expat Tax Numbers For 2022

What To Consider When Deciding To Renounce U S Citizenship For Tax Purposes The Globe And Mail

Green Card Holder Exit Tax 8 Year Abandonment Rule New

Foreign Pensions Expat Tax Professionals

Exit Tax For Long Term Permanent Residents Blick Rothenberg

Green Card Holder Exit Tax 8 Year Abandonment Rule New

Exit Tax For Long Term Permanent Residents Blick Rothenberg

How To Get New Zealand Citizenship The Ultimate Guide

Renouncing Your Us Citizenship Top Questions Answered Youtube