oregon statewide transit tax 2021 rate

Use a oregon transit tax 2021 template to make your document workflow more streamlined. The detailed information for Oregon Transit Tax Rate 2021 is provided.

Oec S Impact 2020 2021 Oregon Environmental Council

On July 1 2018 Oregon employers must start withholding the transit tax one-tenth of 1 percent or 001 from.

. Oregon withholding tax tables. The tax is one-tenth of one. The transit tax will include the following.

Oregon Quarterly Statewide Transit Tax Withholding Return Office use only Page 1 of 1 150-206-003 Rev. Help users access the login page while offering essential notes during the login process. The vehicle use tax which is one-half of 1 percent of the retail sales price applies to Oregon residents and businesses that purchase vehicles from dealers located outside of.

A Statewide transit tax is being implemented for the State of Oregon. Tax rate on Taxable Estate amount more than. Oregon withholding tax formulas.

Oregon withholding tax formulas. Rate Form OR STT 1 Oregon Quarterly Statewide Transit Tax Withholding Return 150. Oregon Income Tax Calculator 2021.

If you make 70000 a year living in the region of Oregon USA you will be taxed 15088. Taxable Estate Equal to or more than. Oregon Statewide Transit Tax Rate 2021 will sometimes glitch and take you a long time to try different solutions.

Your average tax rate is 1198 and your marginal tax rate is. There is no maximum wage base. The Oregon transit tax is a statewide payroll tax that employers withhold from employee wages.

Tax rate used in calculating Oregon state tax for year 2021. Oregon withholding tax tables. Oregon employers must withhold 01 0001.

Taxable Estate less than. Check the box for the quarter in which the statewide transit tax. Oregon salary tax calculator for the tax year 202122.

The tax rate is 010 percent. LoginAsk is here to help you access Oregon Statewide Transit Tax Rate. This change is effective for calendar year 2019.

Statewide Transit Tax Statewide Transit Tax Statewide Transit Tax Starting July 1 2018 youll see a new item on your paystub for Oregons statewide transit tax. Payroll and Self-Employment Tax Information. Effective January 1 2022.

The Oregon Estate Tax rates remain unchanged for 2021. Ezpaycheck How To Handle Oregon Statewide Transit Tax b 500000 or. Taxes that provide operating revenue for TriMet are administered and collected by the Oregon Department of Revenue.

Payroll Systems Attn Oregon Statewide Transit Tax Effective July 1 Payroll Systems

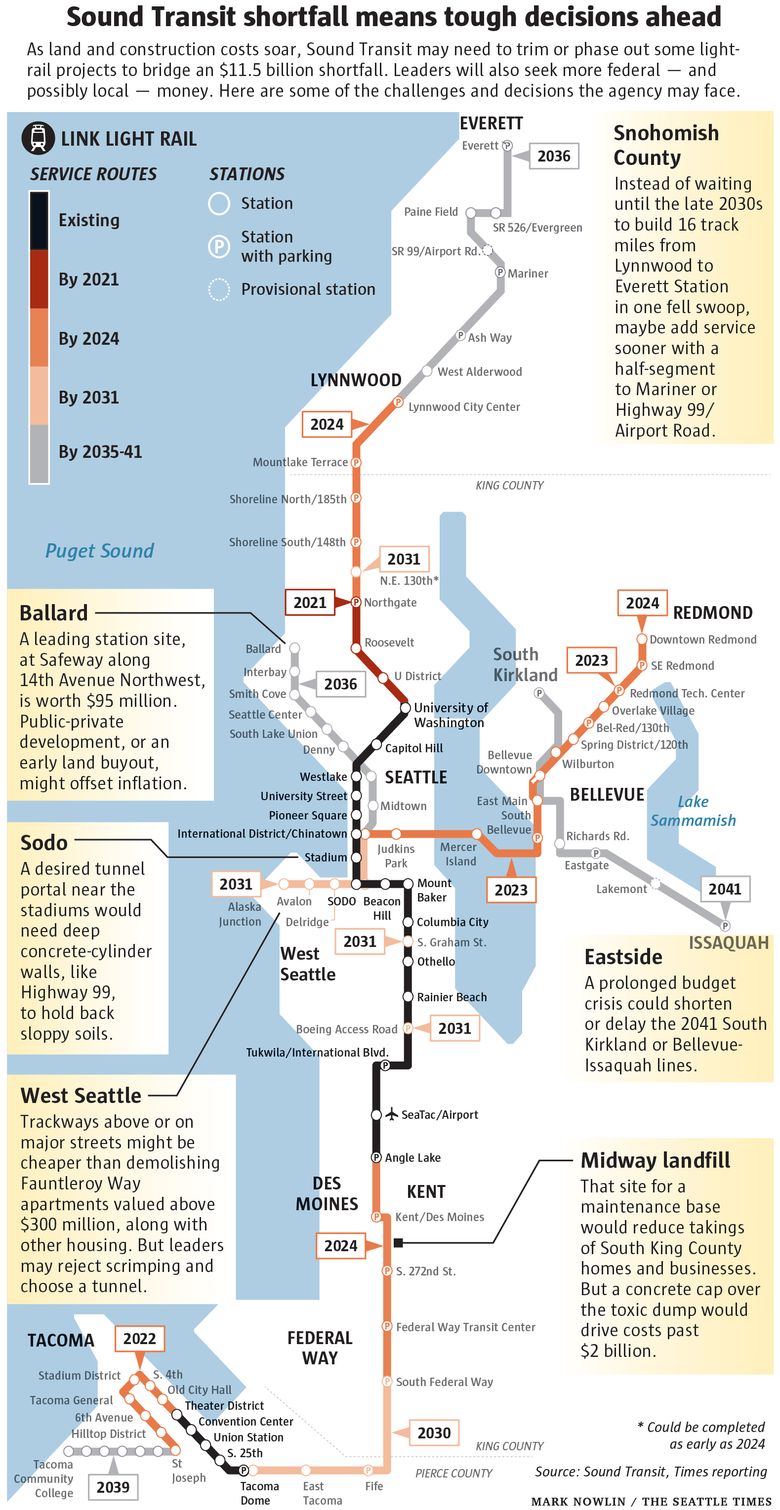

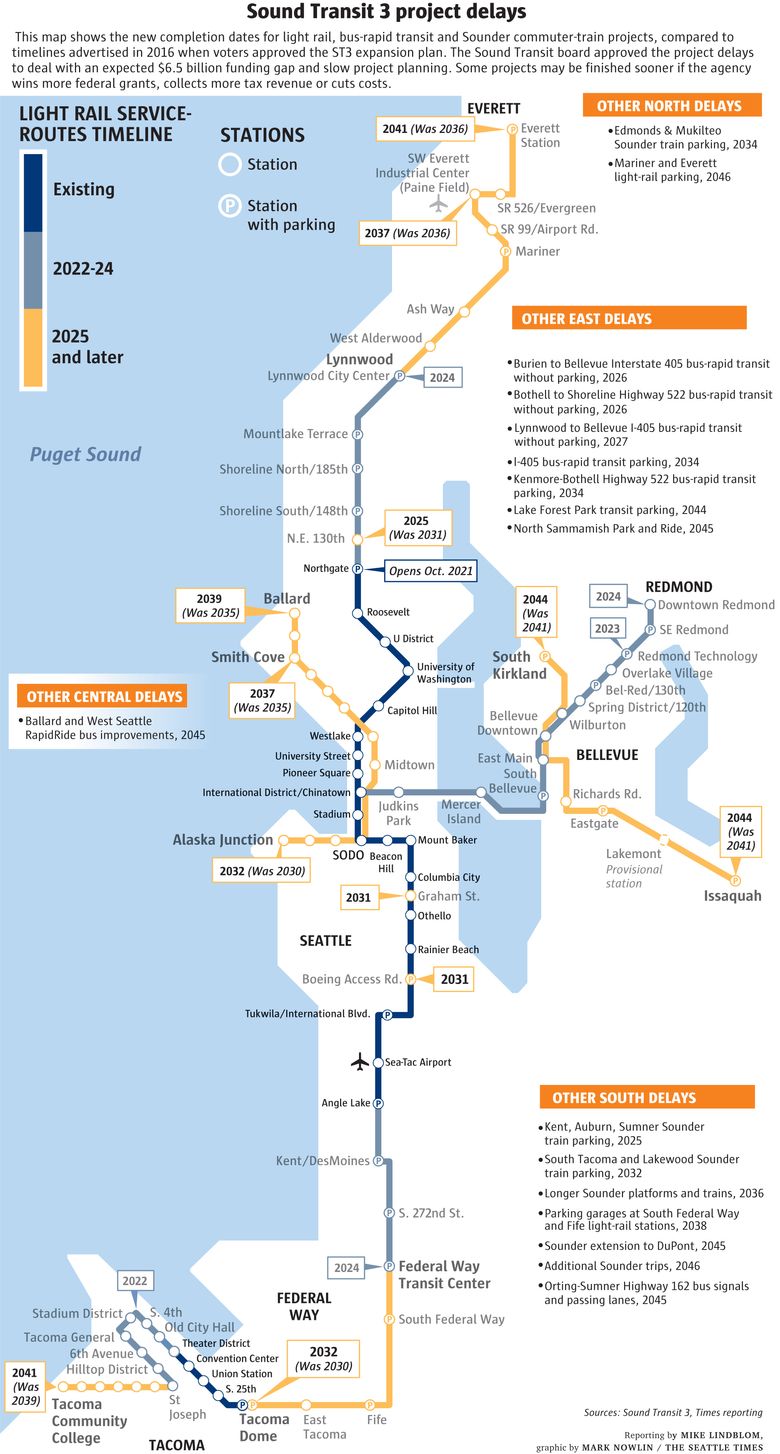

Sound Transit Faces A 6 5 Billion Shortfall Here S What It Might Do The Seattle Times

Oregon Labor Laws The Complete Guide For 2022

Sales Taxes In The United States Wikipedia

What Are State Payroll Taxes Payroll Taxes By State 2022

Blog Oregon Restaurant Lodging Association

Coronavirus Updates Gladstone Oregon

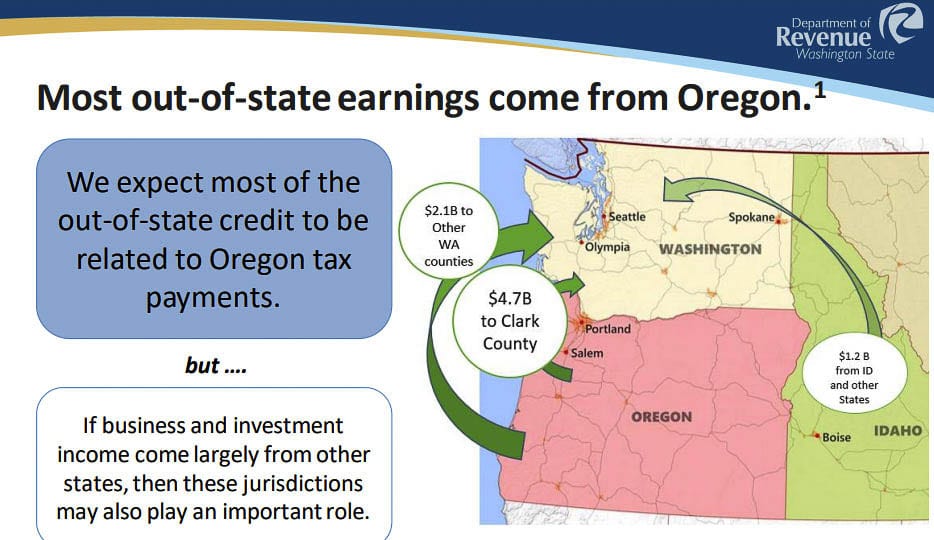

Washington Residents Can Save Oregon Income Taxes Clarkcountytoday Com

The Complete Guide To Oregon Payroll For Businesses 2022

Utah 2022 Sales Tax Calculator Rate Lookup Tool Avalara

A Refresher Transferring Your Oregon Transit Tax Information From Sage 100 To The State

2021 Payroll In Excel Oregon State Transit Workers Benefit Fund Edition Youtube

The Trimet Self Employment Tax Solid State Tax Service

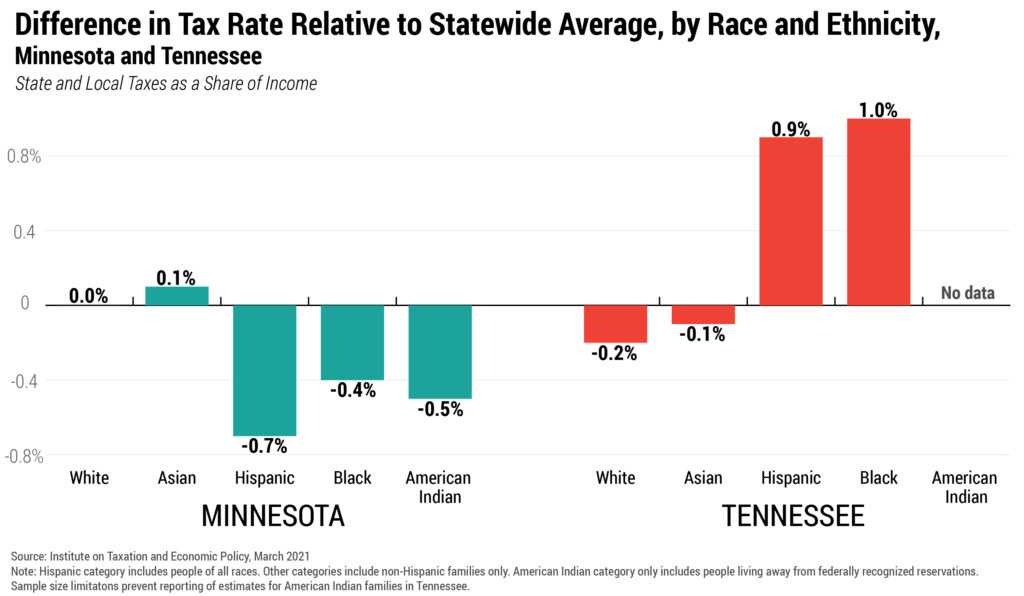

Taxes And Racial Equity An Overview Of State And Local Policy Impacts Itep

.jpg)